Decoding the Delivery Hype Score: A Comprehensive Guide to Evaluating Investment Opportunities in the Tech Sector

Introduction

The world of technology is marked by rapid advancements and a continuous stream of new ideas. With each new development, there is often a mix of excitement and skepticism, as people attempt to discern whether the innovation is a game-changer or merely a passing fad. Understanding the differences between hypeworthy technology developments and meaningless hype is crucial to making informed decisions and predictions about the future of technology. In this essay, we will examine some examples of groundbreaking technologies that have transformed industries, as well as innovations that have failed to live up to the hype. We will also explore possible reasons for overhype and consider whether there is a connection between unexpectedness and success.

Section 1: The Gems – Game-changing Technologies

AI and the Internet are two prime examples of technologies that have had a profound impact on society. The development of AI, particularly OpenAI’s ChatGPT, has revolutionized communication, automation, and decision-making across industries. This AI breakthrough emerged from years of research and development, with relatively little hype preceding its widespread adoption.

Similarly, the Internet, now a fundamental part of modern life, emerged unexpectedly and changed the world. Its development was not met with the same level of anticipation as other technologies, but its impact has been immense. These two examples suggest that sometimes, the most transformative innovations might not be accompanied by a great deal of hype.

Section 2: The Hype – Overblown Expectations and Disappointing Outcomes

Conversely, some technologies receive a significant amount of hype, only to underdeliver on their promises. SpatialOS and Magic Leap are prime examples of this phenomenon. SpatialOS, a cloud-based platform for creating massively multiplayer online games, generated excitement with its ambitious goals but ultimately failed to revolutionize the gaming industry. Similarly, Magic Leap, an augmented reality startup, raised billions of dollars and generated immense hype, but its products have not lived up to expectations.

Section 3: Overhype as a Possible Sign of Future Failure

While it is not universally true that overhyped technologies are destined to fail, there is a possibility that excessive hype might be an indicator of future disappointment. Overhype can be a result of aggressive marketing, unrealistic promises, or overenthusiastic investors, which may lead to unrealistic expectations that the technology cannot meet. This discrepancy between expectations and reality can result in the technology being perceived as a failure, even if it has some merit.

Section 4: Unexpected Gems and the Importance of Vigilance

The emergence of transformative technologies without much hype raises an important question: Are the most significant breakthroughs often the ones that come along unexpectedly? The Internet and AI advancements serve as examples of innovations that materialized without much fanfare but went on to change the world.

While it is difficult to predict which innovations will have a lasting impact, it is essential to approach new technologies with a discerning eye. Rather than being swayed by hype, it is crucial to examine the technology’s potential applications, market readiness, and the team behind it. This vigilance can help identify the gems that will transform industries and make a lasting impact.

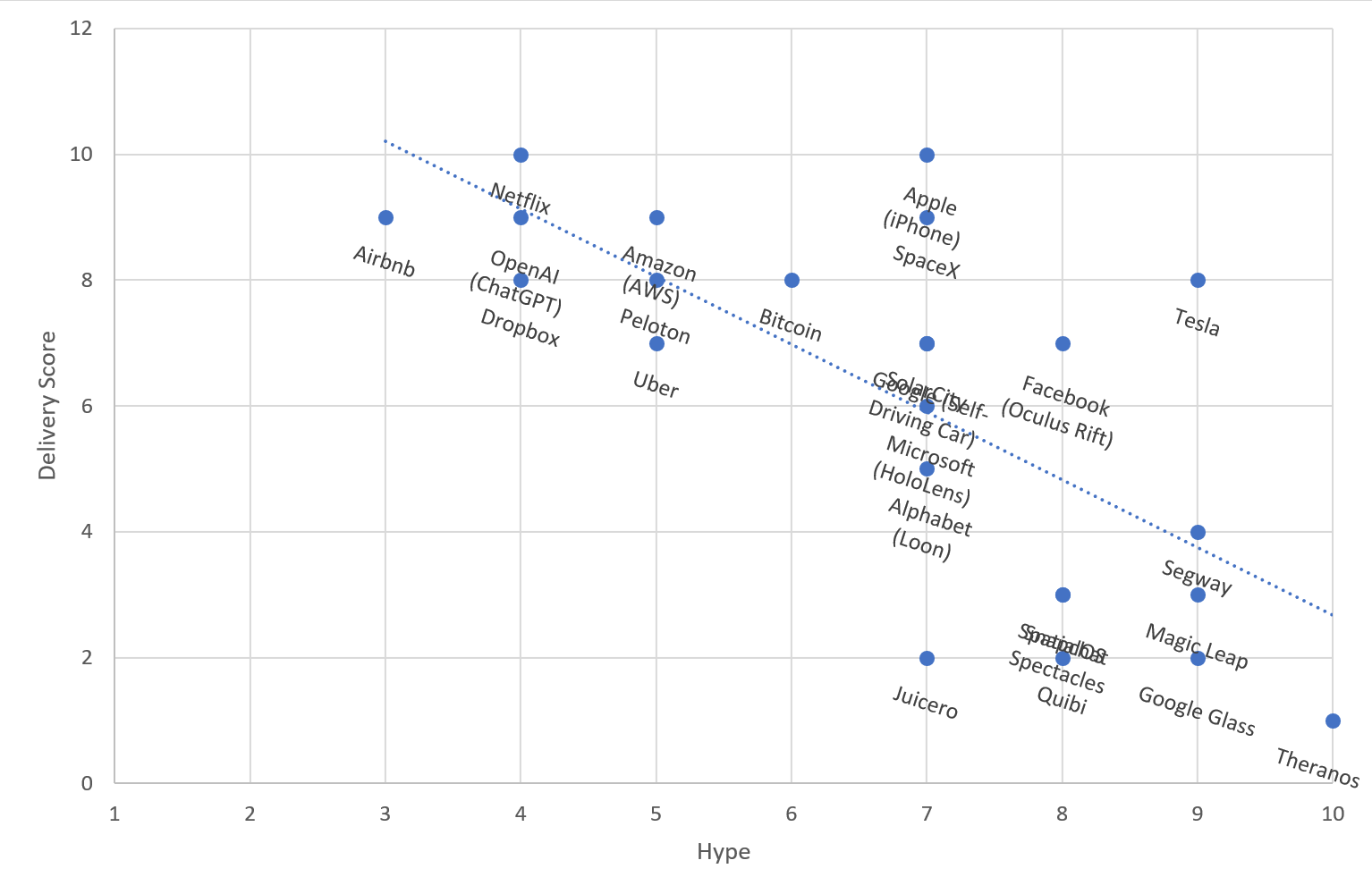

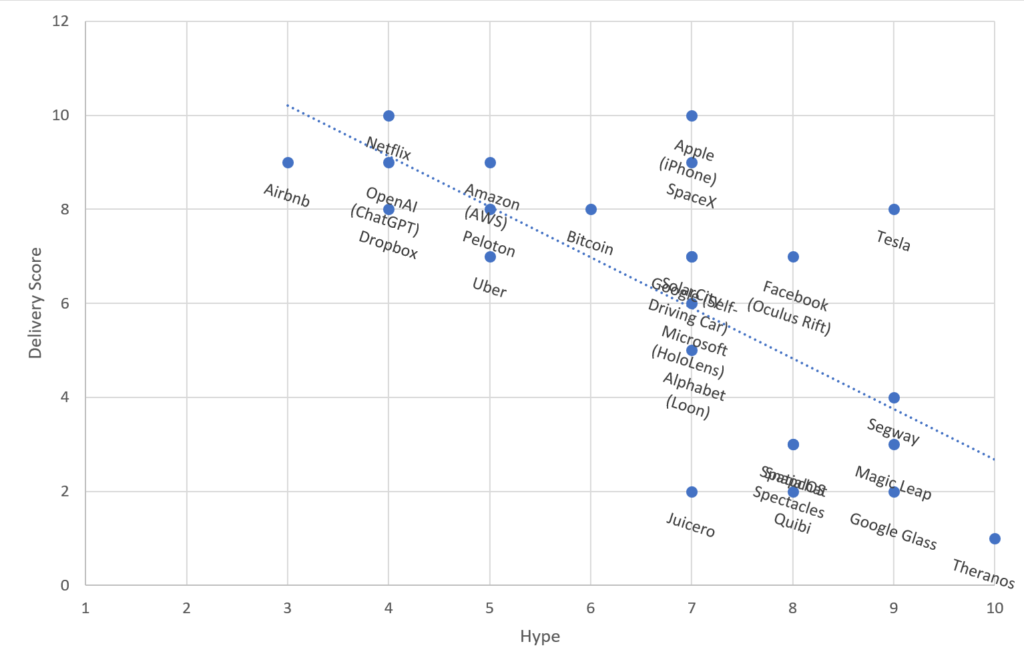

In analyzing the relationship between hype and delivery, we can glean valuable insights by examining notable success stories and failures. A careful study of these examples can inform future investment decisions and guide us in identifying the hidden gems amidst the noise.

One of the most resounding success stories in recent times is Apple’s iPhone. Apple managed to generate significant hype around the iPhone, thanks to the company’s reputation and the visionary leadership of Steve Jobs. The iPhone lived up to the hype, becoming a game-changer in the mobile phone industry and a symbol of innovative design and user experience. With a Hype Score of 7 and a Delivery Score of 10, Apple’s iPhone is a prime example of hyped technology that has delivered on its promises.

On the other hand, Theranos serves as a cautionary tale of hype gone wrong. Founded by Elizabeth Holmes, Theranos claimed to revolutionize the medical testing industry with its revolutionary blood-testing device. The company generated immense hype, attracting substantial investments and partnerships. However, the technology behind Theranos was later revealed to be fraudulent, leading to the company’s collapse and Elizabeth Holmes’ imprisonment in 2022. With a Hype Score of 10 and a Delivery Score of 1, Theranos is an example of a highly hyped company that failed to deliver on its promises.

The scatter plot created with the provided data highlights these examples, with Theranos and Apple’s iPhone on opposite ends of the spectrum. The data visualization helps us identify patterns and correlations that might signal potential successes or failures. In general, a high Hype Score combined with a low Delivery Score could indicate overhype and potential risk. Conversely, a low Hype Score and a high Delivery Score might suggest an undervalued opportunity.

However, it is essential to recognize that hype and delivery are not the sole factors that determine a company’s success or failure. A multitude of external and internal factors, such as market conditions, competition, leadership, and execution, contribute to a company’s performance. While the chart can provide a helpful starting point for analysis, it is crucial to consider these factors when making investment decisions or assessing the potential of new technologies.

In the quest to identify promising investment opportunities, it is crucial to distinguish between meaningful technological advancements and mere hype. The Delivery Hype Score (DHS) serves as a valuable metric for evaluating the balance between the hype and delivery of companies or technologies. By assessing the DHS alongside other factors such as market conditions, competition, financial performance, and management quality, investors can make more informed decisions.

The DHS is calculated using the following formula:

DHS = (Delivery Score + 1) / (Hype Score + 1)

This formula provides a straightforward interpretation: a DHS value greater than 1 indicates that a company or technology has delivered more than its hype, while a DHS value less than 1 suggests it has not lived up to the hype. A DHS value of 1 represents a balance between hype and delivery.

For example, consider the cases of Apple’s iPhone and Theranos from the data we analyzed earlier. The iPhone, with a Hype Score of 7 and a Delivery Score of 10, has a DHS of (10 + 1) / (7 + 1) ≈ 1.375. This value suggests that Apple has successfully delivered on the hype surrounding the iPhone, making it a promising investment. In contrast, Theranos, with a Hype Score of 10 and a Delivery Score of 1, has a DHS of (1 + 1) / (10 + 1) ≈ 0.182, indicating that the company failed to deliver on its promises and was likely overhyped.

However, it is essential to recognize that the Delivery Hype Score should not be the sole criterion for evaluating investment opportunities. The DHS can serve as an initial screening tool, but a comprehensive analysis of other factors is necessary to make robust investment decisions.

For instance, investors should also consider the competitive landscape and market conditions. Companies that operate in highly competitive markets or face significant regulatory hurdles may struggle to deliver on their promises, regardless of their DHS. Similarly, market conditions can impact a company’s ability to deliver, as seen during the dot-com bubble when many overhyped technology companies failed due to unsustainable market conditions.

Moreover, the financial performance and management quality of a company can significantly impact its ability to deliver on its hype. A company with a strong balance sheet and cash flow is better positioned to invest in research and development, driving innovation and delivery. Meanwhile, experienced and skilled management can execute strategies more effectively and adapt to changing market conditions.

In conclusion, the Delivery Hype Score is a valuable metric for identifying promising investment opportunities by assessing the balance between hype and delivery. However, investors should not rely solely on the DHS and must consider other factors such as market conditions, competition, financial performance, and management quality. By incorporating the DHS into a comprehensive investment analysis framework, investors can better distinguish between meaningful technological advancements and mere hype, ultimately making more informed decisions.

Conclusion

In the ever-evolving landscape of technology, it is crucial to differentiate between genuine breakthroughs and mere hype. While some innovations, like AI and the Internet, have emerged unexpectedly and changed the world, others, like SpatialOS and Magic Leap, have failed to live up to expectations. By analyzing the factors that contribute to overhype and maintaining a discerning approach, we can better identify the innovations that hold the most promise and will shape the future of technology.